What Do I Need To Qualify For Bad Credit Loans Online?

You are not alone if you are looking for bad credit loans online. Inflation over the past couple of years, reduced or low-paying jobs due to the economy, and COVID-19 keeping people sick and out of work for weeks has hurt many people. Statistics show that 48 million U.S. citizens have bad credit. While some of this could be the result of mismanaging their budgets, much of it occurred simply because they couldn't make enough to keep up with basic living expenses. If this sounds like you, keep reading this article to learn about bad credit loans available to you.

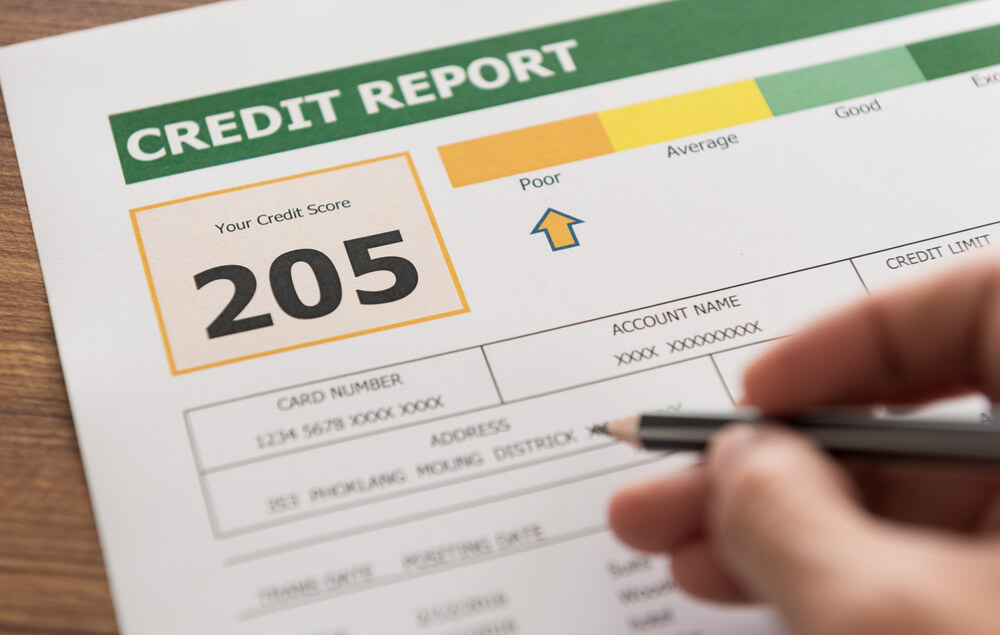

What Is A Bad Credit Score?

Many people don't even know their credit score, but it's definitely something you should know and understand. Only then can you work at fixing it. Credit scores range from 300 to 800. Those closer to 800 are perfect and can get any type of loan they want from a bank or other financial institution. Those who range from 600 to 700 can likely get a loan from the same institutions, although those closer to 600 will have to jump through some hoops and may have more trouble. It could also take longer to get a loan approved.

Those in the lowest ranges from 300 to 599 are considered not creditworthy and typically will not be considered for any type of standard loan from financial institutions. This means you can't buy a car, buy a house, or even be approved to rent an apartment in some cases. It could even affect getting car insurance or a job.

What Causes A Bad Credit Score?

Bad credit scores build up over time and paying things late or not paying them at all is a direct result. Every late or missed payment is reported to one of the three major credit bureaus, TransUnion, Experion, or Equifax. That isn't just credit card payments either. It's doctor's bills, utility payments, rent, or mortgage payments. Even late cell phone payments can be reported.

You are entitled to a free credit report once a year that details your credit history and gives you a credit score. It's a good place to start when you want to try to get a loan. Some information could be wrong and correcting it could improve your score.

Getting Bad Credit Loans Online

It takes time to improve your credit score and you may be in a situation where you need some cash now to help meet your cash flow needs until payday or pay for an emergency like a car repair. When this happens, there are bad credit loans online that could be an option for you. One of those options is payday loans. These loans could help fund your needs until your next paycheck.

Payday loan vendors must be licensed in the state to operate. Those who live in South Carolina have Carolina Payday Loans, Inc. as an option. They offer loans between $100 and $550 and have a simple process that can be completed in a minimum of thirty minutes.

Those with less-than-desirable credit can also apply for loans through Carolina Payday Loans, Inc. easily. Your credit will not affect your request because your job is your job's income secures the loan. Those applying will need a current pay stub providing proof of income, a state-issued picture ID or a driver's license, and a blank check from an active checking account registered in your name.

An Advantage Of Getting This Loan

One benefit of taking out a loan with Carolina Payday Loans, Inc. is it won't affect your credit score. This private vendor doesn't report to credit bureaus if you default on your loan. Other credit companies do "hard pulls" before deciding whether or not to approve your loan and that may have the ability to lower your score, even if you aren't approved or don't take out the loan.

How To Apply

The online form makes it easy to get connected with Carolina Payday Loans, Inc. All you have to do is fill out the inquiry and a representative will call you to explain loan the payday loan process. After that call, you will need to visit the store nearest you to provide your documents for verification. You will also have the opportunity to ask the loan representative any questions you have. Once you are approved, you will get your cash either that day or the next business day. The time frame depends on what time of day you sign the payday loan agreement.

It Doesn't Hurt To Ask

Requesting a loan may be stressful but it doesn't have to be. A friendly representative from Carolina Payday Loans, Inc. can address any concerns you have about getting bad credit loans online. You aren't obligated to take the loan but it is an option for those who need a little help in between paychecks. If you would like more details before you decide, simply fill out the form now to speak with a loan representative today.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.