How To Use A Payday Loan Wisely In South Carolina

Payday loans in South Carolina can be a quick financial lifeline for unexpected expenses, but taking out a payday loan comes with important responsibilities. While the loan industry in South Carolina is highly regulated to protect borrowers, taking out a loan is still not a decision to take lightly.

It is important that borrowers understand that a payday loan should be a last resort for genuine financial emergencies. In this guide from Carolina Payday Loans, Inc., we’ll share practical tips for determining whether a payday loan may be an option for you, and how to use your funds wisely should you opt for one.

8 Responsible Borrowing Tips For Payday Loans In South Carolina

When getting a cash advance in SC, you must ensure that you are making the right decision. You shouldn’t take the responsibility of a payday loan lightly. After all, you must repay the loan with your next paycheck. Before borrowing, learn about ways to ensure you are borrowing responsibly to avoid the pitfalls of undisciplined borrowing.

Here are eight responsible borrowing tips for payday loans in South Carolina:

1. Only Borrow For Emergencies

The key to knowing how to use a payday loan responsibly in South Carolina is to only take out the loan if you have a genuine need for the money. A payday loan isn’t intended for frivolous expenses; it's a last resort for financial emergencies.

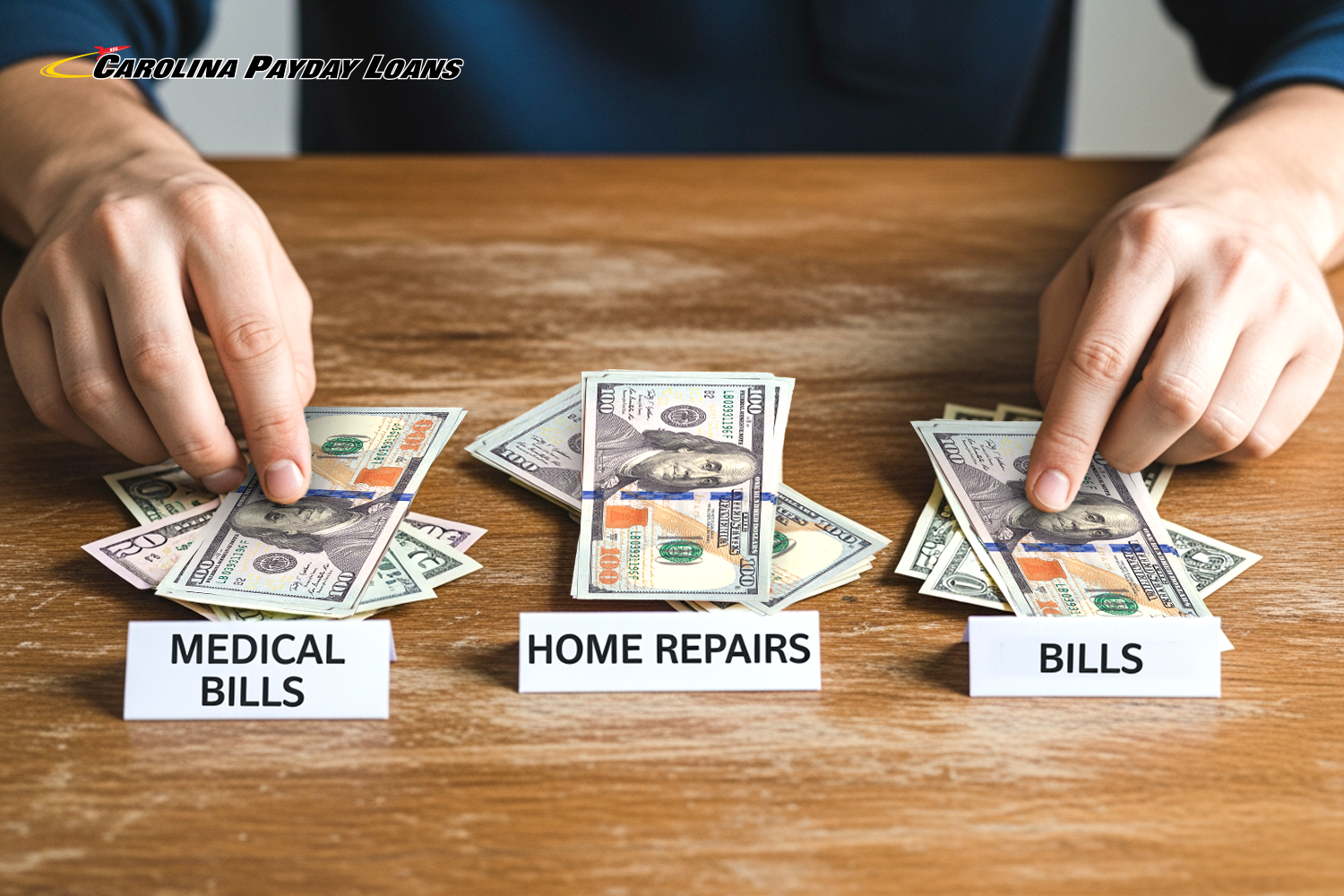

For example, many obtain a payday loan from Carolina Payday Loans Inc. for:

- Overdue bills – Missing rent, mortgage payments, utility bills, credit card payments, etc., can lead to reduced credit, late fees, and service disruptions. Avoid these downsides by borrowing a cash advance and getting the money you need before the due date.

- Medical expenses – Illnesses and injuries don’t wait for your next paycheck. Don’t let your health suffer while trying to save money; get a payday loan to help afford medication, surgery, hospitalization, and other medical bills.

- Auto repairs – Your car is a key part of your life and helps you commute to work, school, the store, etc. A payday loan can help you afford emergency repairs, including replacing the battery, fixing broken windows, and repairing the brakes.

- Home repairs – Some issues around your house can make it unlivable. Pay to get rid of mold, fix structural problems, and repair plumbing issues with a cash advance in SC.

Basically, a payday loan should only be an option if an expense needs to be covered right away. If you don’t have a pressing need to cover an expense before your next paycheck, then don’t opt for a payday loan. In this case, you should consider alternatives other than a cash advance.

2. Explore Alternatives

Payday loans in South Carolina should be a last resort. If you’ve got other options, then use them. For example, borrowing cash from friends & family members can be a better solution. Some employers may also give a salary advance if you’re handling a true financial emergency.

Some people may also choose to sell unwanted items on online marketplaces, which can bring in some essential cash. You can also work a side hustle, such as driving for Uber, freelance writing, or graphic design, if you have some time before you need to pay the cost.

You should only consider a cash advance in SC after exhausting all other options. You also must make sure that you can qualify for the loan before applying.

3. Make Sure You Meet The Requirements

At Carolina Payday Loans, Inc., we have only a few requirements for borrowers to meet to get approved. You must provide proof of your identity, age, income, and checking account. Thankfully, this can be done easily with our short list of required items.

Here are the required items for a payday loan in South Carolina:

- A driver’s license or state-issued photo ID that displays your full name and date of birth

- Your most recent pay stub to verify your income

- A blank check from an active checking account in your name

As long as you have these items, you have a good chance at getting approved for a South Carolina payday loan. Before proceeding with the process, think about how much you need to avoid borrowing more than what’s necessary.

4. Borrow Only What You Need

At Carolina Payday Loans Inc., we can offer payday loans ranging from $100 to $550. The exact amount you may qualify for will depend on your income and ability to repay the loan. However, this doesn’t mean that you need to borrow the full amount available to you. Only borrow what you need.

Borrowing exactly what you need makes repayment more manageable, reduces fees, and helps you avoid spending your cash advance on non-essential items. You should think of a payday loan as a way to cover one unexpected cost, not to fund all your costs.

5. Consider A Payday Loan A ‘One-Time’ Fix

A payday loan is not something you should come to rely on; it should be a ‘one-time’ fix to help you get through a financial emergency. They are not something you should depend on each month.

If you find yourself regularly relying on payday loans, we suggest exploring alternative options. For example, taking a part-time job or learning how to budget slightly better. Cutting non-essential expenses from your life can go a long way toward avoiding the need for a payday loan.

In South Carolina, you cannot get a second payday loan if you still have an existing one. There are strict limits on how frequently you can take out payday loans, and these rules apply to all reputable lenders in the state to protect you. Hopefully, this will motivate you to consider other options instead of relying repeatedly on payday loans.

6. Only Borrow From Reputable Lenders

Getting a cash advance in South Carolina isn’t just about spending the money you borrow wisely; it is also about ensuring that you borrow from reputable lenders. This means ensuring that the lender is properly registered with the South Carolina Department of Consumer Affairs and has been in business for a significant period. This ensures that you’re properly protected when borrowing cash.

The following are some of the things you should look for in a trustworthy lender:

- Name, address, and phone number displayed prominently on their website

- Transparent terms (requirements, approval process, loan amounts, etc.)

- No upfront fees

- Friendly loan representatives who won’t pressure you

- Certification displayed on website

At Carolina Payday Loans, Inc., we’ve been in business for over 30 years. We have branch representatives located throughout the state, ensuring that people can get their emergency cash safely and quickly through our simple approval process.

7. Understand The Payday Loan Approval Process Before Applying

Our approval process only takes a few steps, all of which you can complete within one day. You can begin the process online before finishing in person at one of our branches. Prepare ahead of time by learning what the process entails so you can handle it properly.

Here are the steps involved in the payday loan approval process:

- Fill out our online form – We have a short form on our website for you to fill out with your name, email address, phone number, and zip code.

- Speak to a loan representative – Once you’ve submitted the form, a representative from your closest Carolina Payday Loans, Inc. branch will give you a call. They’ll let you know a little bit more about how we work. We’ll also answer any questions you have. This is a no-obligation phone call. If you’re not interested in the loan at this point, that’s completely fine.

- Get approved in person – After the phone call, you can gather your required items and head to the nearest South Carolina store location. Once there, we will verify that you have all of the documents we require, and your information matches across them. This process will take less than 30 minutes.

- Sign the loan agreement – You can finish the process by filling out our loan agreement. You can now receive your cash advance later the same day or by the next business day.

Once you have gotten approved for a payday loan, you must immediately start thinking about how to repay the loan.

8. Repay on Time

Payday loans are repaid in full with your next paycheck. This includes any interest you have collected. You need to make sure you can afford to repay it the next time you get paid.

You need to budget for the right amount of cash in your account on the due date. When you take out a payday loan, repayment should always be your number one priority. Failing to repay the loan on time can lead to late fees that make repayment even more expensive.

Get A Payday Loan In South Carolina – Borrow Up To $550 Today

Do you need fast emergency cash for an unexpected cost? As long as you follow our responsible borrowing tips, you can use a payday loan effectively to afford your expenses. At Carolina Payday Loans, Inc., we have a simple approval process, and borrowers of all credit types are accepted. Just fill out our online payday loan form and visit us in person to get approved within 30 minutes.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.